Overview

A Federal Tax Credit, which is known as an investment tax credit or ITC, is described in Internal Revenue Code (“IRC”) Sec 38 (the General Business Credit). IRC Section 38 provides for several different ITC’s, such as the low-income housing tax credit, the historic rehabilitation tax credit, and the renewable energy tax credit. This paper will focus on the renewable energy tax credit,(i.e. the Solar ITC) which, as described in Section 48 of the IRC provides for a capital investment tax credit calculated as a percentage of the basis of “energy property” that has been 1 “placed-in-service” during a particular taxable year. “Energy property” is defined in the IRC as 2 equipment which uses solar energy, hydro-electric power, wind, biomass, or geothermal technologies to generate electricity, and as such allows the costs for installation and equipment for commercial solar installations to be eligible for tax credits.

Renewable energy is an unlimited resource in that it comes from the sun, wind, water, and so forth, and is a positive alternative to fossil fuel-based power generation, which as a natural resource is limited. Therefore, developing our renewable resources rather than full reliance on our dwindling natural resources is enormously important. Renewable energy production is also less harmful to our environment, which could help us with global warming issues, as well as to reduce our reliance on foreign oil, which enhances our national security interests. Solar ITCs are necessary to allow the renewable energy industry to achieve scale and give the industry time to stabilize while production technologies advance and achieve cost efficiencies which can sustain the industry. Accordingly, the Solar ITC is one of the most important federal policy mechanisms to support the deployment of solar energy in the United States.” Solar Energy Industries Association (SEIA).

The Solar ITC was originally created in the Energy Policy Act of 2005 and made applicable to projects placed in service by December 31, 2007., The Solar ITC was extended thereafter to December 31, 2008, by the Tax Relief and Health Care Act and extended multiple times subsequently. The latest Omnibus Appropriations Act changed the “placed-in-service” requirement to a “commenced construction” designation, allowing projects to qualify for the 30%, 26%, or 22% credits if construction was commenced prior to 2019, 2020, or 2021, respectively, and the project is placed-in-service prior to December 31, 2023. In the Consolidated Appropriations Act, 2021, Congress extended the Solar ITC at 26% for two years, i.e., from January 1, 2022, to January 1, 2024.3

Tax Credits as a Strategy

Generally speaking, ITC’s allow a dollar-for-dollar offset of income taxes that a person/entity claiming the ITC would otherwise pay to the federal government assuming they are eligible to utilize the ITC. Accordingly, receiving ITCs at a discount to par value allows investors to offset 4 income tax liabilities on certain revenue streams at 100% par value of the ITC’s. Taxpayers can utilize their ITC’s to satisfy their own tax obligations or allocate their ITC’s to other taxpayers. The reason this happens is because certain taxpayers, such as newly formed single asset entities that hold newly constructed solar assets, may not have generated sufficient income to be able to utilize their ITC’s. For such taxpayers, partnering with another taxpayer to allocate the ITC’s to them is a better alternative than anticipating the future usability of those ITC’s. Conversely, for the taxpayer who receives the ITC’s for less than the $1 value of each ITC— such a transaction may result in substantial tax savings. Note however that although the Solar ITC is not transferable, a taxpayer may utilize the Solar ITC by participating as a partner in a partnership with the developer/owner of the solar project. In this context, the form of the transaction would be an investment into a special purpose entity, usually a limited partnership or a limited liability company taxed as a partnership (hereinafter the “Fund”), which will invest into a solar project thereby securing the Solar ITC’s, depreciation (losses), and cash flow for its members or partners, rather than an outright sale/purchase of the ITC’s.

The Fund’s investment in the solar project must have an “economic purpose” such that the Fund 5 as the taxpayer coming into the partnership with the developer/owner does not do so purely for the purpose of extracting the ITC’s, but rather is engaged in a partnership with the developer/owner that has an economic return apart from the ITC’s along with an associated risk. Essentially, the Fund (and correspondingly its partners) should share in the transaction’s downside (i.e. bear responsibility for transaction risk), and also share in the upside, such as the economics of the transaction. Generally, the amount contributed by the Fund only covers a portion of the full amount of the project costs and the developer/owner borrows the funds for the portion of the capital stack not funded by equity. As each partner in the Fund has a basis equal to its equity investment, and the Fund will generate tax benefits, particularly depreciation, well in excess of that basis, the Fund and its partners need to have sufficient “at risk” basis which is created by the investor’s (i.e. the Fund’s partners) proportional guarantee of the loan. Therefore, it is incumbent upon the investor to evaluate the risk of the project including the source of income (including the company standing behind the commitment) and expenses to be comfortable that the partnership can repay the loan.

How do tax credits work, and how can they be effectively used by taxpayers?

Utilizing a tax credit strategy requires advanced planning and should be funded with resources that otherwise would be used to pay taxes. It is important to realize that, although you are making an investment in a transaction that generates ITC’s, a substantial portion of the return are the ITC’s themselves and an investor should not expect the return of its invested capital. With that in mind, the following is an explanation of how a typical tax credit transaction would work.

Benefits

- The primary financial benefits of a solar tax credit strategy are summarized below (a more detailed explanation is provided in the Benefits Statements on page 8). An individual investor with passive income can expect the following returns:

- Tax Credits (i.e., ITC’s calculated as 26% of the cost of the equipment and related installations) that can be used to offset federal tax liability (this is not a deduction, but a

dollar-for-dollar reduction in taxes); - Negotiated annual cash flow between the tax credit investor and the sponsor member for a five-year period;

- Deductions against income related to partnership losses created by the depreciation of the equipment and installation costs of the project; and

- An exit payment when the sponsor member purchases a substantial portion of the ownership of the partnership from the Fund (usually after year five).6

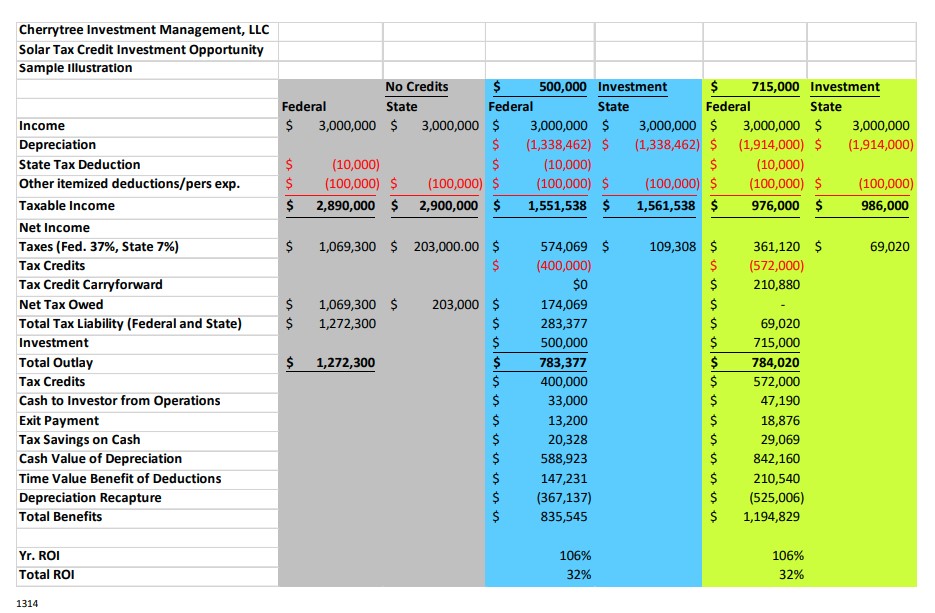

In the illustration of the Benefits Statement on page 8, the ROI is 32% which is typical for this type of solar transaction. More important for the investor’s consideration is when the ROI is received. Unique to this investment, the taxpayer/investor receives tax benefits in the first year (Solar ITC’s and depreciation) that exceed the amount of investment. When properly timed, the investor can lower their tax payment due to the IRS before making the investment and thus, have no net cost in the transaction. As stated above, the referenced tax credit strategy is only useful to those taxpayers that otherwise would have needed to pay taxes to the federal government and is more beneficial for those taxpayers whose excess tax bracket is 37% or greater.

Consider also that this tax credit investment can be considered an ESG compliant investment, thereby providing much more than a financial return. 7 8

While the ITC’s flow 100% upfront (and can be claimed in the year that the solar assets are placed-in-service), the ITC’s face a recapture risk over a 5-year period. It is for this reason that these transactions are generally structured as a partnership that flips the equity interests of its partners at the end of year 5 (when the recapture risk has burned off) and the sponsor member then acquires a substantial portion of the investors’ interest.

Who can use Tax Credits?

Tax credits, and in particular the Solar ITC can be most easily used by corporations, because the IRC currently limits certain taxpayers’ use of the Solar ITC. Specifically, individuals, trusts, Closely-Held subchapter C corporations, subchapter S corporations or personal service corporations are required to comply with the passive loss and at-risk rules in their use of the Solar ITC. An investment in a solar utility project by a Closely-Held C Corporation (where more than 50% of the stock is held by five or fewer individuals after application of certain attribution of ownership rules among related parties) and personal service corporations, trusts, or passthrough entities composed of such entities or natural persons, will only be suitable to the extent that such taxpayers can satisfy the rules relating to passive activity credits and losses and “at-risk rules”. The passive activity rules and the “at risk” rules can vary substantially and serve to reduce such taxpayers’ ability to take advantage of the Solar ITC’s and tax losses expected to be generated by their investment in the Fund. Taxpayers subject to the Sec. 469 passive activity rules (i.e., individuals) cannot offset non-project (active and portfolio) income with the tax credits (and losses) received, i.e., they can only use the tax credits to offset their passive income. Furthermore, individuals utilizing depreciation (losses) to exceed their basis must comply with the at-risk rules (IRC Sec. 465) in addition to the above-mentioned Sec. 469 (passive loss) rules.9 IRC Sec. 469 provides that individuals and Closely-Held C corporations must be at-risk with respect to the tax credit basis that produces the Solar ITC. There is also a separate at-risk rule under IRC Sec. 465 that applies to individuals and Closely-Held C corporations and addresses only the losses from the solar project. The IRC Sec. 465 rules differ from the separate at-risk rule applicable to the Solar ITC discussed above in that only recourse (versus nonrecourse) financing provides the at-risk basis that an investor would need to exceed its basis. Accordingly, analyzing the rules from both IRC Sections 465 and 469, the conclusion is that in order for an investor to deduct the losses from the solar project, the investor’s share of the capital stack only provides at-risk basis to the extent of the combined amount of equity and recourse debt, but not any type of nonrecourse debt,10 Moreover, in calculating the depreciable basis of the solar 10

project, and thereby the losses allocable to the investor, the investor’s capital account must be reduced by 50% of the Solar ITC.

Limitations

Unless the investor is active in the solar project, the investor must have enough passive income from other sources to be able to deduct the losses from the solar project i.e., the passive activity. In addition, there must be enough tax on the investor’s remaining passive income to offset the tax credits. To further clarify, the losses from the passive activity (primarily depreciation) are first deducted from the passive income from other sources. Any remaining passive income from other sources can then offset the tax credits. Note: to receive the tax credit benefit, it is not the amount of passive income that is relevant; it is the amount of taxes that are due on the remaining passive income (after deducting the losses from the passive activity). Further, there’s a 75-85% limitation on the amount of taxes that can be offset with the Solar ITC.

IRC Section 461(l) which was part of the 2017 Tax Cuts and Jobs Act further limits a net deductible business loss to only offset a maximum of $500,000 (for married individuals filing joint returns) of non-business income in a single year. However, since this loss limit only applies after the passive loss limit applies, it won’t have any practical impact on the amount of passive losses that are deductible, since passive losses are not deductible unless the taxpayer has passive income. Accordingly, if the taxpayer has enough passive income to offset the passive loss, then this additional $500,000 loss limit would not be an issue.

Keep in mind that there are three types of income and loss: (1) passive; (2) active; (3) portfolio. The first two categories are business income/loss. The third category is basically all other, but generally is investment activity. There is an ordering rule to follow: (1) determine how much loss is at-risk; (2) determine if the at-risk loss is active or passive; (3) limit the deduction of net passive losses to passive income (the excess loss is carried to the next year); (4) any active business net loss can only offset $500,000 of nonbusiness income; (5) any passive credits are limited to the tax on net passive income; and (6) any allowable credits after (5) are limited to 75-85% of total tax.

Structural Considerations

The IRS, through its Procedural Rulings has allowed for certain Safe Harbors that apply specifically to wind deals and historic tax credits and such Procedural Rulings have been interpreted to apply to solar energy property as well. These Rulings describe how a tax credit transaction should be structured such that the IRS would respect such a transaction. IRS Rev. Proc. 2007-65 (for wind projects) has been used to respect the partnership allocations of Sec. 45 Renewable Energy Credits, and IRS Rev. Proc. 2014-12 issued safe harbor guidance for allocating Sec. 47 Historic Rehabilitation Credits. These Safe Harbors differ, but generally contain the following structural principles:

- Developer must own at least 1% of the project entity.

- The Fund must own at least 5% of the project entity.

- The Fund must make and maintain an unconditional minimum investment (“UMI”) of (a) 20% of the sum of the capital contribution when the Fund acquires its interest in the project entity, and (b) by no later than the placed-in-service date, 75% or more of the UMI must be fixed and determinable, which means capital contributed to the project entity.11

- The investor cannot be protected against loss and the partnership may not guarantee the investor’s ability to claim the tax credit.12

- Neither the investor nor developer can have a put or call option that is for less than FMV, and the developer call option (only allowable in a renewable energy deal) cannot be exercisable earlier than 5 years after the placed-in-service date.

Prospective investors should note the special rules that apply to determine whether it will be able to qualify to utilize the tax benefits anticipated from an investment in the Fund. Each Investor should reasonably expect to have, for each of the next six to eight years, sufficient federal taxable income from passive sources and actual or anticipated tax liability to utilize the Solar ITC’s and losses anticipated from its investment.

Prospective investors should also realize that because every taxpayer’s personal circumstances are different, that each investor needs to consult their tax advisor/CPA to determine that the tax credits and deductions from the pass-through losses (primarily depreciation) result in the tax savings discussed in this white paper.

Who Are We?

The Cherrytree Group, LLC is a specialist tax credit company that provides tax credit consulting services, brokers state tax credits, and has built out a platform to syndicate federal tax credits to individuals (with passive income), closely held companies, trusts, and Family Offices. Through our Preserve and Renew partnerships, we syndicate federal tax credits by creating either a special purpose entity that owns the assets or through a sale lease-back structure, providing our investors with federal tax credits, a portion of the cash flow, and depreciation. We only work with Solar ITC’s, Historic Tax Credits, and Low-Income Housing Tax Credits. To date, we have successfully closed on several investment partnerships and brokerage transactions exceeding $100 million in state and federal tax credit incentives.

Typical Structure

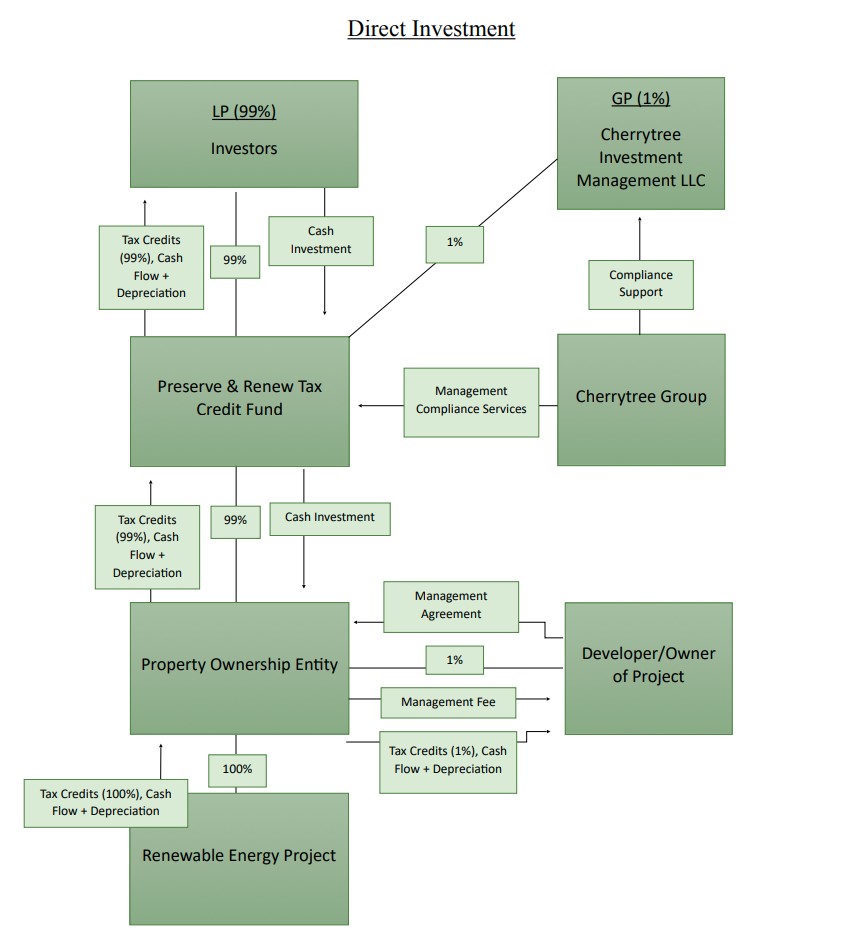

Federal tax credit transactions are usually structured as a direct transaction (where the Fund takes a direct equity interest of the owner of the property), or an indirect transaction (where a specific tax credit entity is set up that enters into a Master Lease with the owner of the property).

As we primarily use the direct investment structure, only the direct investment structure is depicted below:

(1) The benefit schedule assumes the Investor has enough passive income in Yr. 1 of the investment to offset the allocated depreciation and tax credits.

(2) The benefit schedule assumes the LLC will utilize bonus depreciation on the system and the Investor will be able to realize allocated losses in excess of equity basis from their share of debt basis. Any losses allocated in excess of equity basis would be recaptured as ordinary income when the Investor exits the partnership.

(3) The tax on depreciation recapture can potentially be avoided if (i) the projects are in an Opportunity Zone as the income would be considered capital gains thereby being able to be offset via the OZ Rules, (2) The Fund invests in an additional solar tax credit project prior to the Yr. 6 exit, and (3) The project has additional income or the Sponsor agrees to a tax payment to the Fund to offset the exit tax liability.

Note: This illustration is for presentation purposes only. Any investor needs to have his/her tax advisor review and prepare their

own analysis. Other significant provisions are necessary to understand the complete terms and investment

consideration.

FOOTNOTES

1 Basis, which is focused on intently in this paper, is the amount of a taxpayer’s capital investment in property for tax purposes.

2 As described below, the Solar ITC is now 26% of the basis of energy property, however, the IRS in Notice 2018-59 provides 2 guidance and a safe harbor for when a solar project is deemed to have commenced construction. There are two ways that a project can claim to have commenced construction and therefore be entitled to safe harbor its Solar ITCs at the 30% level, i.e., the physical work test and the 5% safe harbor. The 5% safe harbor is the more useful test for us to “grandfather” Solar ITCs at 30%.

3 See Rules Committee Print 116-68, Text of the House Amendment to the Senate Amendment to H.R. 133 (December 21, 2020), specifically, Subtitle C, Section 132 (Extension and Phaseout of Energy Credit).

4 See Section below entitled “Who Can Use Tax Credits” for an explanation of the eligibility for use of tax credits.

5 This is what is hereinafter referred to as the “partnership” with a developer/owner.

6 The exit payment is usually structured as an option most commonly exercisable by the sponsor member, it is not a guaranteed payment.

7 Environmental, social, and governance (ESG) criteria are a set of standards for a company’s operations that socially conscious investors use to screen potential investments. Environmental criteria consider how a company performs as a steward of nature.

8 Comprised of the Solar ITC’s, depreciation (losses) and cash flow, represented by a preferred return (based upon the Fund’s investment in the solar assets) annually for 5 years and an exit payment at the end of year 5 (also based upon the Fund’s investment in the solar assets).

9 It is noted that the corporate alternative minimum tax was repealed effective as of January 1, 2018.

10 Usually, qualified non-recourse debt is acceptable, i.e., loans from an unrelated lender that is in the business of lending money.

11 As basis is created by the equity invested, we recommend that the total investment is made prior to the project being placed in service.

12 This is a separate requirement from those basis rules that require an investor to have sufficient “at-risk” basis in order to claim all the losses generated by the investment.

13 Includes the Yr. 1 tax benefit from the cash received and the time value of money benefit for Yr. 1.

14 As the cash to investor from operations is received tax free there is a tax savings of $20,328 & $29,069 respectively. Additionally, there is a time value of money benefit for the Yr. 1 deductions if the tax on depreciation recapture is only triggered in Yr.6 of $147,231 & $210,540 respectively.

This does not constitute an offer to buy or sell securities and is intended for educational purposes only. For more information, contact The Cherrytree Group at (617) 431-2266 or e-mail to: info@cherrytree-group.com.

Warren founded Cherrytree in 2011 and has spent the past eleven years building a highly specialized tax credit consultation, brokerage, and syndication firm. He has relied on three decades of experience and a law background to focus on the structural and development finance aspects of tax incentivized real estate-based transactions — particularly in the environmental remediation (Brownfields), renewable energy, and historic rehabilitation areas.