The Cherrytree Group.

Helping developers and investors secure and monetize tax incentives for commercial real estate.

A new milestone for Cherrytree: over $130 million in tax credits secured nationally.

Specialists in Federal and State tax credit programs for real estate investment and development.

Your state and Federal governments want to encourage businesses and individuals to rehabilitate historic or low-income properties, clean contaminated land and generate energy from the sun. Enlightened developers and investors can sharply reduce equity needs and achieve significant tax savings by taking advantage of tax credit programs meant for conscientious development. We can show you how.

Cherrytree’s services are ideal for:

AREAS OF EXPERTISE:

OUR SERVICES:

Federal Tax Credits

Cherrytree has developed a first-in-the-industry platform to bring the same tax credits to individuals and closely-held companies that the large institutions and multinational companies have relied on for decades. Our specialty is in creating and managing partnerships that own projects generating $5 million or less in tax credits, depreciation and cash flow. These partnerships are ideal for non-institutional investors who have significant passive income to be able to properly use the tax credits.

Federal Tax Credits

Cherrytree has developed a first-in-the-industry platform to bring the same tax credits to individuals and closely-held companies that the large institutions and multinational companies have relied on for decades. Our specialty is in creating and managing partnerships that own projects generating $5 million or less in tax credits, depreciation and cash flow. These partnerships are ideal for non-institutional investors who have significant passive income to be able to properly use the tax credits.

State Tax Credits

For Brownfields and state historic property development we handle transactions of all sizes — including some of the largest state credits issued over the past few years. Our state tax credit investors include medium-size investors, large institutional companies, and multinational corporations.

State Tax Credits

For Brownfields and state historic property development we handle transactions of all sizes — including some of the largest state credits issued over the past few years. Our state tax credit investors include medium-size investors, large institutional companies, and multinational corporations.

Indemnification for Investors

Cherrytree offers an indemnification to tax credit investors in the event of a recapture of the tax credits — which operates as an important safeguard and comfort factor for our clients. Our indemnification is backed by an in-force insurance policy. To date we’ve never had a claim or loss.

Indemnification for Investors

Cherrytree offers an indemnification to tax credit investors in the event of a recapture of the tax credits — which operates as an important safeguard and comfort factor for our clients. Our indemnification is backed by an in-force insurance policy. To date we’ve never had a claim or loss.

Value for Investors

Recent IRR/ROI projections for our renewable energy partnerships and historic building partnerships show that when depreciation and cash flow are factored in, an investor’s net return will likely range from 31 – 49% — extremely attractive for those investors who have incurred passive income tax liabilities.

Value for Investors

Recent IRR/ROI projections for our renewable energy partnerships and historic building partnerships show that when depreciation and cash flow are factored in, an investor’s net return will likely range from 31 – 49% — extremely attractive for those investors who have incurred passive income tax liabilities.

Bridge Funding up to $10 million for developers

While we traditionally fund our programs internally, Cherrytree also has up to $10 million available for bridge funding prior to the completion of investor commitment on large partnerships. This assists our developers in accelerating construction and drives down the tax credit pricing in your favor.

Bridge Funding up to $10 million for developers

While we traditionally fund our programs internally, Cherrytree also has up to $10 million available for bridge funding prior to the completion of investor commitment on large partnerships. This assists our developers in accelerating construction and drives down the tax credit pricing in your favor.

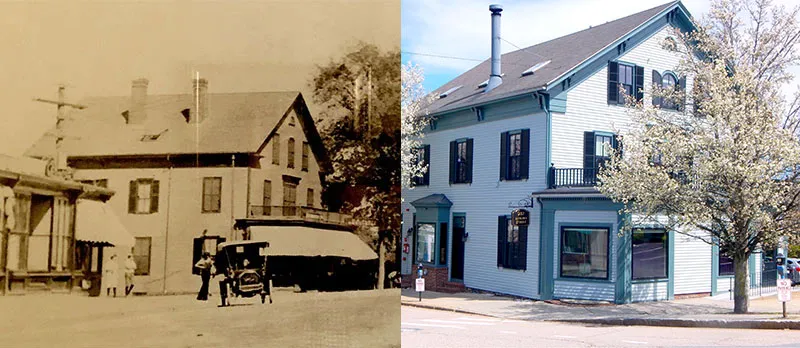

We practice what we preach.

When the Cherrytree team outgrew our headquarters in Newton Highlands (just outside of Boston), we didn’t just look for an office building. We searched for —and finally found — a wonderfully historic structure, conveniently located in the Auburndale neighborhood of Newton. The building needed much work, but we used our tax credit expertise to benefit from Federal tax credits for historic renovation, and are in the beginning stages of planning renewable energy systems which will yield even more tax credits. It’s a microcosm of what we accomplish for our clients every day, and we’re proud to be able to preserve a beautiful building in the Greater Boston community.

Analyze

Developers: we’ll show you the best path to maximize your tax credit eligibility — and demonstrate how to benefit even if you can’t use the credits yourself. Investors: we’ll arrange a partnership with a developer to reduce your tax liabilities.

Facilitate

We put together the package. With a thorough and up-to-date knowledge of the rules and regulations, we’ll make sure your pathway to success remains clear. Our syndication services are tried and tested, and are supported by a team of experienced professionals.

Manage

All application and compliance actions are undertaken by our office, leaving you free to do what you do best: work on your project. For investors, we’ll work with your CPA and/or legal team to structure the deal so it’s perfect for you.

Consult

You’re never alone in the process. Our team shoulders the burden, yet keeps you notified as to progress and milestones. And if you need advice on an existing tax credit project, we’re always happy to help.

Latest Publications

As a service to our colleagues in real estate development and investment, Cherrytree’s analysts frequently hold seminars and write blogs and white papers on current trends in the universe of real estate tax credits.