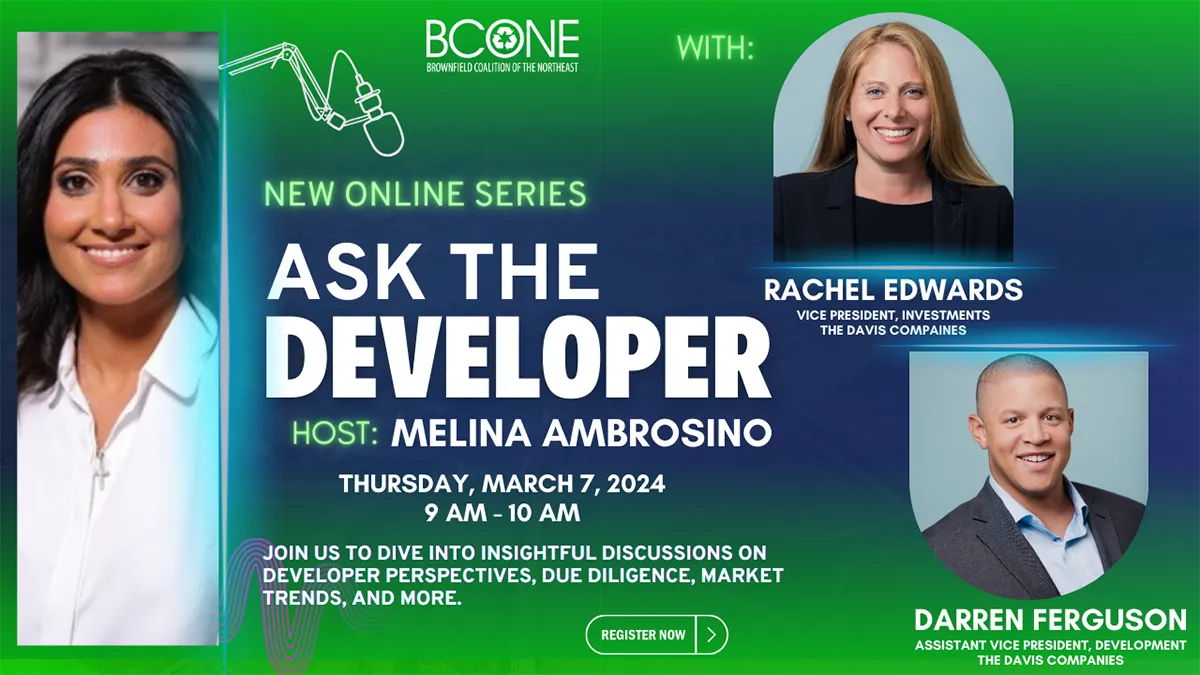

New Online Series: Ask The Developer

Following the phenomenal success of “Developer Roundtable” at #NSCW2023, we are excited to announce that Brownfield Coalition of the Northeast (BCONE) is introducing a new online series “Ask The Developer”! Cherrytree Group’s, Melina Ambrosino will be hosting this online series that delves into insightful discussions on developer perspectives, due diligence, market trends, and more!

Join us for the premier of “Ask The Developer” on Thursday, March 7, 2024 from 9 AM – 10 AM with Melina, BCONE President and President of the Cherrytree Group as she dives into enlightening discussions with Rachel Edwards and Darren Ferguson from the Davis Companies.

Save the date! You don’t want to miss out on this opportunity to connect with experts and elevate your skills to the next level.

Registration Fee

BCONE Members: $25

Non-Members: $40

Help Invest in the Next Generation of Brownfield Professionals!

As a premier sponsor of this event, we would like to invite you to join us at Harpoon Brewery on December 14th, 2023 for some holiday networking! All proceeds from this event will benefit the BCONE Scholarship Fund.

Don’t miss this opportunity to network, enjoy unlimited food and drinks, and most importantly help invest in the next generation of brownfield professionals!

Limited seats are available, be sure to save your spot now!

Diamond in the Rough: Redeveloping Distressed Sites

On Wednesday, November 1st, our own Melina Ambrosino, along with other leaders in the development sector, will speak about the mechanics of land assembly and the role of the public sector in financing redevelopment opportunities, including mixed-use and urban infill developments that have utilized brownfields, historic, housing, infrastructure, and tax increment financing incentive tools. The panel will include the perspectives of developers, financiers, economic development professionals, and tax credit specialists who have partnered with states, municipalities, community groups, and federal agencies on the successful redevelopment of hundreds of sites that are now in active use and providing economic and social benefits to communities.

Click here to register for this virtual event! Deadline is October 31st.

Women in Environmental, Construction, Architecture and Engineering Professions

On Tuesday, November 14th, Cherrytree President, Melina Ambrosino, will act as moderator of a panel of women who will dive deeper into how two real estate developers combat inflation’s effects on their projects. They will also discuss portions of the Inflation Reduction Act and the role it plays in remediation and redevelopment projects. Panelists will review how companies are helping employees cope with the effects of inflation and how women can support one another.

Boston Business Journal 40 Under 40

Cherrytree Group is excited and proud to be sponsoring the Boston Business Journal’s 2023 40 Under 40 Awards where our own president, Melina Ambrosino, is one of the honorees.

Come help us celebrate Melina and the rest of the 2023 honorees Thursday, October 26th at the Boston Harbor Hotel. It will be a disco themed awards celebration so groovy attire is recommended!

For more event information, and to secure a ticket, click here

2023 Northeast Sustainable Communities Workshop

Cherrytree Group is excited to present and sponsor this year’s 2023 Northeast Sustainable Communities Workshop (NSCW) BCONE Event!

This year’s theme is “Strategies for Successful Redevelopment.”

Join other passionate environmental professionals from all over New England and discover new advances, research and case studies in environmental sustainability and resilient redevelopment.

Sponsoring a conference like NSCW could elevate your brand’s position in the industry, enhance brand recognition, and generate profitable leads.

Join over 300 developers, consultants, government officials, and decision makers in Worcester, Massachusetts on September 19th and 20th.

If you are interested in speaking at the 2023 NSCW please visit: https://www.brownfieldcoalitionne.org/nscw-presentation-call

For information on sponsoring the 2023 NSCW please visit: https://www.brownfieldcoalitionne.org/event-5240559

Massachusetts Networking Event 2023

Cherrytree Group is honored to be hosting this Brownfield Coalition of the Northeast Networking Event on Monday, March 13th from 5:30 pm – 7:30 pm at our office in Newton, MA. Registration is $35 for BCONE members and $55 for non-members, with opportunities to register as a Gold or Silver Sponsor as well. Cherrytree will provide drinks and appetizers. This is a great chance to meet people who work in our field and get to know each other, especially if you plan to attend the EnviroWorkshops PFAS Remediation presentation in Boston on Tuesday, March 14th.

2022 Northeast Sustainable Communities Workshop

Cherrytree Group presented at a workshop titled “A New Era for Equitable Development” in Stamford, CT in September of 2022. A variety of topics were covered in one- and two-hour panels dedicated to sustainability issues in both Connecticut and Massachusetts. Attendees could earn Licensed Environmental Professional (LEP) credits and Licensed Site Professional (LSP) credits.

Novogradac’s two-day Renewable Energy and Environmental Tax Credits Conference

Cherrytree’s CEO Warren Kirshenbaum and President Melina Ambrosino joined top deal makers from around the country in Denver, Colorado, for Novogradac’s two-day Renewable Energy and Environmental Tax Credits Conference. With built-in networking breaks and an exclusive reception for attendees, this was a great chance to connect with leading professionals within the renewable energy world.

This conference provided a great opportunity to be immersed in discussions of the latest industry trends, emerging technologies, tax credit equity pricing, and financing strategies while also taking part in valuable professional development and networking sessions. This is an exciting time for renewable energy with potential growth on the horizon.

Revitalizing New England: Brownfields Summit 2022

In May 2022, Cherrytree Group’s President Melina Ambrosino and Vice President Jake Vezga, who are among the top consultants in Massachusetts, attended the two-day conference in Devens, MA. The summit’s goals were to share information about the financial incentives, liability protections, and technical and other assistance from federal and state governments for Brownfield development, and to promote best practices and lessons learned across states.

NEWIEE (New England Women in Energy and the Environment)

On April 28th, 2022, Melina and Jake attended NEWIEE’s 11th Annual Awards Gala celebrating the accomplishments of women in the energy and environment fields! The Gala gathers professionals (women and men) from across New England for an inspirational evening celebrating four awardees, distinguished women from New England who have driven change.

The keynote speaker was Elin Katz. Rachel Kyte earned the Leadership Award.

Meg Lusardi and Marissa Paslick Gillett received the Achievement Award. These women demonstrate excellence in a variety of professional settings, including leadership on the national, regional, or local levels. Keirstan Field earned the Rising Star Award, and Shalanda Baker earned a special NEWIEE Board Recognition.

Big Ideas: How to Maximize on Opportunities

The Cherrytree Group played a very big part in a two-day presentation by the Brownfield Coalition of the Northeast (BCONE). The June 2021 workshop was intended to provide real estate professionals and investors with the tools needed to successfully take advantage of various “Big Ideas” surrounding development in New York, New Jersey, Connecticut, Massachusetts, Rhode Island, Vermont, New Hampshire and Maine. Presenters included both Warren Kirshenbaum and Melina Ambrosino of the Cherrytree Group, who spoke about the major role tax credit efficiencies can play in commercial real estate development.

Preservation Massachusetts: 2021 Awards Program

The entire month of May 2021 was devoted to honoring the best initiatives taken by Massachusetts developers to preserve and protect our historic structure. The Cherrytree Group is proud to be a sponsor of the Preservation Massachusetts Awards program and took part in a live virtual event on May 20.

Preservation Massachusetts is a statewide non-profit historic preservation organization dedicated to preserving the Commonwealth’s historic and cultural heritage. It advocates for stronger preservation legislation at state and federal levels and forms partnerships that fund the preservation of historic buildings.

32nd Annual Preservation Achievement Awards

Bestowed annually since 1988, the Preservation Achievement Awards honor outstanding achievements in historic preservation and compatible new construction in Boston. The Cherrytree Group is pleased to have been a sponsor of this event, which was held in October 2020.

The evening was hosted by journalist Katie Couric and included visual narratives of this year’s outstanding projects that reveal there is always more to the story!

Developing Planning: Utilizing Incentives for New York and Massachusetts

The New England Expansion Committee of BCONE held a Developing Planning: Utilizing Incentives conference in August 2020. This webinar focused on the Brownfield Tax Credits as well as Opportunity Zone regulations.

Speakers included Alan Knauf, Partner of Knauf Shaw, LLP; Melina Ambrosino, Executive Vice President of Cherrytree Group; and Warren Kirshenbaum, President of Cherrytree.

The virtual event provided the audience with the tools they need to successfully take advantage of various incentives during Brownfields remediation. The seminar covered the New York Brownfields Tax Credit program, an update on the newly released working draft regulations of the Massachusetts Brownfields Tax Credit program and insight into the hot topic of Opportunity Zones.

Calculating best ways to develop using tax credits.

The Cherrytree Group hosted their 4th Tax Credit Conference in 2019. Cherrytree Group’s Warren Kirshenbaum and Melina Ambrosino teamed up with Keynote Speaker Brian Earley of The Kraft Group & NPP Development, Lawrence Curtis of Winn Development, and Robert Atwood LSP & P.E.

The panel drew from their professional knowledge to educate the audience on various state and federal tax credit incentives. Brian Earley walked us through some of the energy efficiency additions at Gillette stadium, after which the panel focused on providing the audience with the tools they need to maximize on equity and tax credits for your next project!

Developing a Brownfields Site: Building a Toolkit for Success

The Cherrytree Group hosted their 3rd conference “Developing a Brownfields Site: Building a Toolkit for Success” The event features a panel of guest speakers:

George Vallone, President, Hoboken Brownstone Company; Joseph Quarantello, Senior Vice President, Risk Strategies; Paul Connors, Vice President, Business Development, JMe Corporation; William Alpine, Esq., Corporate Counsel and Director of Cost Recovery, Environmental Compliance Services, Inc. and Warren Kirshenbaum, President, Cherrytree Group.

This was a panel discussion which drew experts from several different fields together to discuss how to work together and essentially form a team to develop a Brownfields site without ‘breaking the bank’. Our panelists included an environmental developer, lawyer, engineer, insurance broker, and tax credit consultant. Each panelist spoke about the role they would play in developing the site and then the floor was opened up for question and answers from the audience.

Other recent events:

Cherrytree Tax Credit Conferences

In recent years, the Cherrytree Group has sponsored, hosted and presented four Tax Credit Conferences at the Boston Marriott Copley Square Hotel. In addition to Cherrytree management, speakers included Kerry Bowie, Director of Brownfields and Environmental Justice, Massachusetts Department of Environmental Protection, and Richard Cote, P.E., LSP, Comprehensive Environmental, Inc. Together, we discussed the various environmental tax credits available and gave our perspectives on the current climate in the tax credit industry.

The speakers explained the Massachusetts Brownfields and Renewable Energy programs from both a government and private sector perspective, focusing on the intersection of these programs. Specifically, we discussed a tax credit model gaining popularity, wherein Brownfields sites are outfitted with Renewable Energy infrastructure (either in addition to other improvement or as a stand-alone facility), effectively turning them, “From Brownfields into Brightfields”.

ABX: Redeveloping a Historic Building

Cherrytree Group’s Warren Kirshenbaum and Melina Ambrosino teamed up with Barry Ganek of Ganek Architects and VJ Tocci of Tocci Building Companies to present at the Abx Conference. During this presentation, the panel described what every real estate professional needs to know about the adaptive reuse of a historic building. The panel discussed -the application process for filing for the state and federal Historical Tax Credit; how tax credits can be used to finance a project; the important role that architects play in the redevelopment of the building, and the Tax Credit structuring issues; as well as the fundamentals that go into the design and construction of a historic building. The panel also talked about assembling the ideal team to maximize the tax credit.

Massachusetts Historic Preservation Tax Credits

Cherrytree President Warren Kirshenbaum has been a panelist at two recent Massachusetts Historic Preservation Conferences. The Panel focused on the commonwealth’s Historic Rehabilitation Tax Credit. Warren was joined by Doug Kelleher and Brian Lever, Epsilon Associates, Inc.; Dan Kolodner, Esq. of Klein Hornig LLP; and and George Vasvatekis of 1620 Capital LLC.

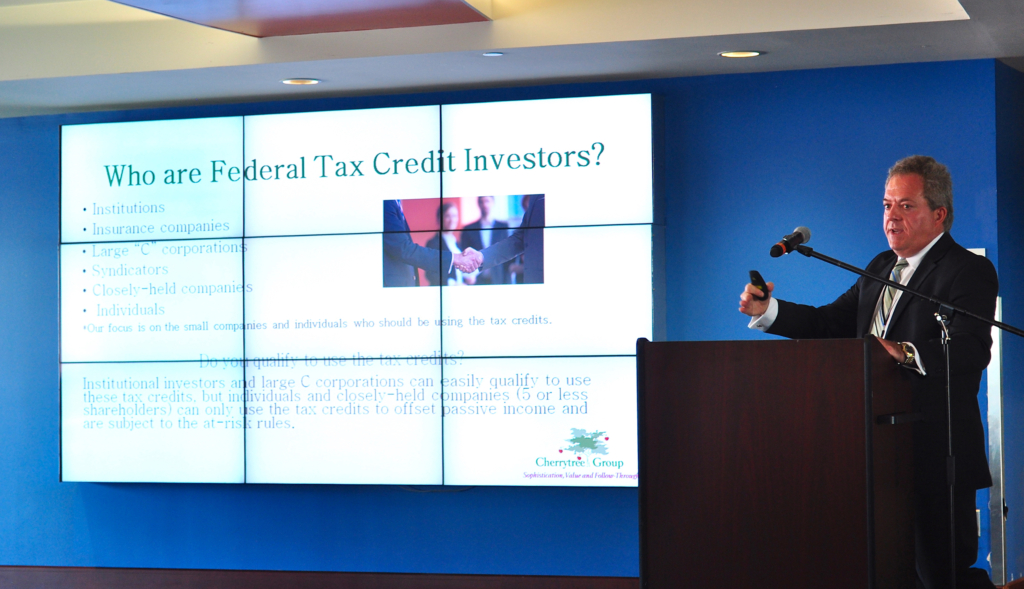

Marcum Microcap Conference

Cherrytree’s Warren Kirshenbaum was part of a panel presenting on the topic of Federal tax credits at the Marcum Microcap Conference, held at the Grand Hyatt Hotel in New York City. Marcum is one of the world’s most influential accounting and advisory group.

Brownfields in the State of Rhode Island

Rhode Island’s Environmental Business Council hosted Cherrytree President Warren Kirshenbaum to speak about the tax credit benefits of undertaking projects involving the removal of contaminated land. The symposium, “Helping move Rhode Island’s Economy Forward” was held at the Providence Offices of Adler Pollock & Sheehan, Attorneys.

Site Remediation & Redevelopment Programs

Warren Kirshenbaum of Cherrytree Group was a panelist on the EBC’s Site Remediation & Redevelopment Program: Massachusetts Brownfields Update at the offices of Brown Rudnick law firm in Boston.

Brownfield Remediation Strategies

The Licensed Site Professional’s Association (LSPA) created a continuing education course for its members: “A Licensed Site Professional’s Guide for Understanding and Navigating ehe regulatory and technical challenges of an Underground Storage tank (UST) Release in Massachusetts.” Cherrytree president Warren Kirshenbaum was a panelist for the session, held at the Sheraton Framingham Hotel & Conference Center.

Real Estate Roundtable

The Cherrytree Group took part as presenters at a Real Estate Roundtable hosted by DiCicco Gulman & Co. — a Boston area CPA firm. The event was hosted at the Boston Marriott Copley Square, and covered the topic of real estate tax credits — including the Massachusetts Brownfields Tax Credit.